Social media posts suggest the American Rescue Plan Act of 2021 enacted a tax on peer-to-peer payments made through online services such as PayPal, Venmo and others. This is false; the law included no new taxes on such transactions, although it did change reporting requirements to make it easier to collect them from people using the platforms for business.

Also Read: Staff Shortage, Not Vaccine Strike, Caused Flight Cancelations in US

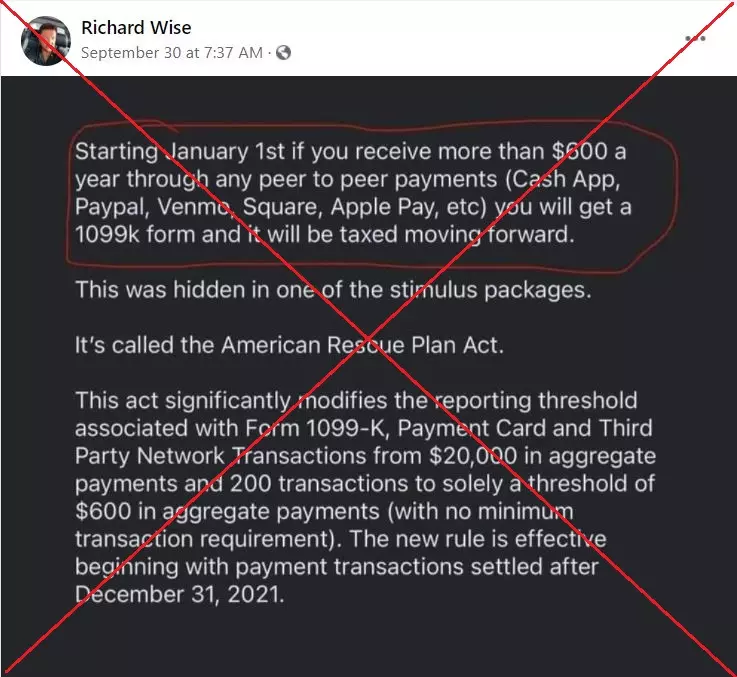

"Starting January 1st if you receive more than $600 a year through any peer to peer payments... you will get a 1099K form and it will be taxed moving forward," a September 30, 2021 Facebook post says, adding that the measure "was hidden in one of the stimulus packages. It's called the American Rescue Plan Act."

Screenshot of a Facebook post taken on October 8, 2021 The claim appeared elsewhere on Facebook as well as on Twitter.

But the $1.9 trillion stimulus package aimed at addressing the impact of the COVID-19 pandemic, which President Joe Biden signed into law on March 11, did not institute a new tax on transactions through apps or online payment services.

"The American Rescue Plan (ARP) does not impact the tax treatment or information reporting on most peer to peer transactions through third party settlement organizations, like PayPal and Venmo," the US Treasury told AFP.

"ARP clarifies that information reporting is limited to transactions for the provision of goods or services only (i.e. situations in which a taxpayer is using a third-party online payment processor to sell goods or services to the public)," it added.

The law did however change the threshold for reporting business income received through the payment platforms from $20,000 annually to $600.

Also Read: Posts Falsely Claim California Ports Backlog Has Been Done Intentionally

Garrett Watson, a senior policy analyst at the non-profit Tax Foundation, said the law did not change what counts as taxable income, and that person-to-person payments for gifts and reimbursements, or charitable donations, would not be subject to tax.

"However, if one is using platforms like Venmo or PayPal to accept payment for business purposes, that could be taxable income that would be reported" to the Internal Revenue Service, Watson said. "That income is already taxable under the existing law, so it is just changing what is visible to the IRS."

A spokesperson for PayPal, which also owns Venmo, said the new requirements go into effect January 1, 2022 for all companies.

"This is specific to payments received for goods and services, so this doesn't include things like paying your friend back using PayPal or Venmo for reimbursements, such as splitting the dinner bill amongst family or friends," the spokesperson said.

Accounting consultancy PwC made a similar point in a March 2021 blog post, saying: "The Act clarifies that third-party network transactions include only transactions for the provision of 'goods or services.' As a result, personal gifts, charitable contributions, and reimbursements are not included."

(Except for the headline, this story has not been edited by BOOM staff and is published from a syndicated feed.)