The decision of the Reserve Bank of India (RBI) to slash the repo rate (the rate at which the RBI lends to commercial banks) by 50 basis points has surprised many. But both the domestic and external economic environment warranted big steps by the RBI to induce economic growth.

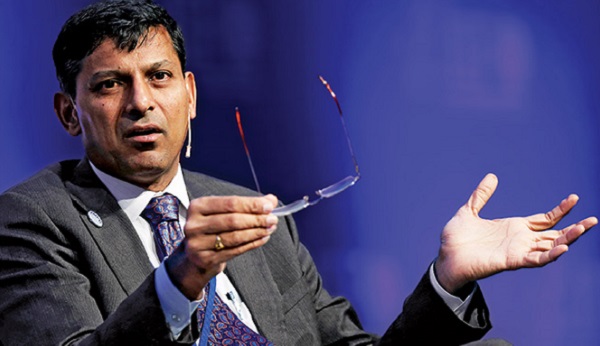

The RBI governor, Raghuram Rajan, had previously taken baby steps to reduce interest rates, focusing strictly on inflation. Now the repo is at 6.75 per cent, the level of 2011, down from 8 per cent at the start of 2015.

The Indian government is targeting a growth rate of 8–8.5 per cent, but the country’s actual year-on-year growth in the April–June quarter was 7 per cent. The latest RBI announcement is in line with expectations that the government will push to revive investment and demand in the economy. With this in mind, the rate slash was not a big surprise but the right call.

The RBI’s mandate clearly defines it as an inflation targeting institution. Yet the moderation of consumer price inflation over the last few months left space for the RBI to turn its attention to stimulating economic growth and encouraging investment. The present consumer price index figure of 3.66 per cent in August, which is well within the suggested inflation target range of 2 percentage points below or above 4 per cent, along with lower commodity prices across sectors, except food, created the perfect timing for a big rate cut.Commodity prices are not expected to spike in the near future since the economic growth of China — the world’s largest consumer of commodities such as crude oil, metal, chemicals and natural gas — is slowing progressively. India’s exports have been sluggish and negative for the last two quarters. Boosting domestic demand to offset export declines is therefore the need of the hour. In India, low domestic demand for commodities has led to an under-utilisation of capacity (use of less than 70 per cent of capacity) in Indian industry.

Another indicator that says it all about consumption and investment demand is credit off-take, the growth of credit available to the private sector. Credit growth in last few quarters has been lower than expected despite the RBI cutting the repo rate by 25 bps three times in 2015. The RBI’s earlier gradual approach to repo rate cuts did not bear much fruit as those announcements followed expected lines. Banks were less responsive to monetary policy and delayed passing on the benefits to both consumers and investors.

This time the 50 bps rate cut, on top of the earlier rate cut of 75 bps across the year, will certainly have a visible impact on credit off-take, investment, consumer demand and overall growth.

Lower capital costs are expected to boost capital expenditure from companies struggling with cash flows. There has been a lack of institutional funding to the infrastructure and housing sectors. The high cost of loans has slowed down borrowing and thus demand, and many projects have become unviable. Banks and financial institutions are suffering from associated high rates of non-performing assets, which means some companies are struggling to source financial capital. But lower capital costs may change this.

The rate cut has also come just in time to boost consumer demand before festive sessions like Navaratri and Diwali. Cheaper loans will attract consumers for both borrowing and investing in housing, automobiles and retail. Housing in particular is a big sector that impacts demand on other sectors like construction, metal and cement and in turn overall economic activity.

But it all depends on the pace and magnitude of monetary transmission, which has been slow in India. In contrast to the modest effects of the RBI’s previously gradual rate cuts, the response this time has been quick. The leading public sector banks — including State Bank of India, Punjab National Bank, Bank of Baroda — and some private sector banks, including ICICI, have already announced a cut to their base rate by 40 bps applicable with immediate effect. It’s only a matter of time before other banks and financial institutions follow suit.

Overall, the RBI’s rate cut is based on economic merit. The decision of the US Federal Reserve to postpone its expected rate hike has also helped Rajan take this positive step. The reduction in interest rates certainly adds to the impression encouraged by Indian Prime Minister Narendra Modi in his recent visit to the United States that India is ready for investment. India has now arguably pipped China to become the most attractive destination for foreign direct investment in the world.

But interest rates are just one of the factors affecting the decisions of investors and consumers. The Indian government must secure their faith in the ease of doing business in the country, which will need reforms at reasonable pace on issues like goods and services tax, regulatory mechanisms and governance.

This article has been republished from Eastasiaforum.org.