FILE PIC: People eat breakfast at Mani's Lunch Home in Mumbai

Imagine receiving a bill at the end of a meal at a restaurant. The bill shows you a break-up of the amount with the state (SGST) and central GST. You pay the bill and walk off.

But wait, look again. An alert Pune based chartered accountant Jagdish Lade found at a local restaurant that he was charged GST despite the restaurant not having received its GST number. Jagdish refused to pay Rs 25 charged as GST and informed the restaurant of the rules that prohibits an unregistered entity from collecting tax from its consumers. After several calls with their chartered accountant, the restaurant manager informed Lade that they are yet to receive the GST registration number. The tax amount was returned after Lade insists he cannot be charged.

Lade posted the information on his Facebook page on August 18 and the post has gone viral with over 95,000 shares and 25,000 likes.

"They kept saying system has not been updated. I made it clear to them that they cannot charge GST and if they continue to do so, action can be taken against them. When they realised that I am aware of the rules, they decided to return the tax charged on my bill," said Lade in an interview to BOOM.

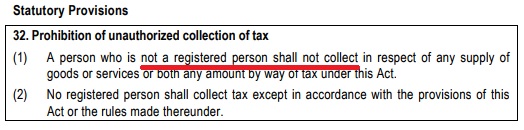

BOOM verifed the relevant rules and found Lade's claim to be correct.

But Jagdish Lade is a chartered accountant who runs his own firm. How can citizens not well versed with GST provisions find out if the restaurant charging them GST has the legal right to do so?

Here are certain tips Lade has mentioned in his Facebook post to make it easy for you.

1) How to identify registered or unregistered dealer?

Registered dealer should print GST number on their bill.

2) How to verify the printed GST number?

You can verify GST number through this link: https://services.gst.gov.in/services/searchtp

3) What are the GST rates applicable at restaurants?

- For non-AC/non-alcohol serving hotels, it is 12%

- For AC/alcohol-serving hotels, it is 18%

- For turnover less than Rs 75 Lakhs per year and restaurants opting for composition scheme, it is 5%.

4) In case of GST fraud, where can we file a complaint?

- Email : helpdesk@gst.gov.in

- Phone: 0120-4888999 , 011-23370115

- Twitter: @askGST_Goi , @FinMinIndia